In today’s digital-first economy, more U.S. businesses are relying on virtual accounts receivable outsourcing to simplify their cash flow operations. Whether you’re a growing startup or an established enterprise, managing invoices, collections, and client communications can be time-consuming and error-prone if done manually.

But as virtual AR outsourcing gains momentum, one question keeps surfacing: how do businesses ensure risk management and compliance in a virtual setup?

Let’s explore how companies can safely embrace virtual AR solutions while keeping compliance, accuracy, and financial integrity intact.

The Rise of Virtual Accounts Receivable Outsourcing

Remote work and automation have changed the way finance teams operate. Instead of hiring in-house AR staff, many companies now outsource accounts receivable processes to virtual teams or cloud-based service providers.

This approach not only cuts overhead costs but also ensures access to skilled professionals and modern automation tools—without geographical limitations.

With trusted virtual AR partners, businesses can efficiently handle invoicing, collections, payment reconciliation, and credit control virtually, ensuring faster cash conversion and reduced Days Sales Outstanding (DSO).

However, with this convenience comes the need for robust risk management and compliance measures.

Why Risk Management Matters in Virtual AR Outsourcing

Outsourcing accounts receivable virtually introduces specific challenges, especially related to:

-

Data privacy and client confidentiality

-

Compliance with financial regulations

-

Process transparency and accountability

-

Cybersecurity and data breaches

Without a structured risk management plan, even a small compliance lapse can lead to financial losses or reputational damage. That’s why successful outsourcing depends on balancing efficiency with compliance discipline.

1. Data Security and Confidentiality Controls

When you manage client billing, credit details, and payments virtually, protecting sensitive financial data becomes your top priority.

How to Mitigate the Risk:

-

Choose a compliant provider. Ensure your virtual AR partner follows standards like SOC 2, GDPR, or ISO 27001.

-

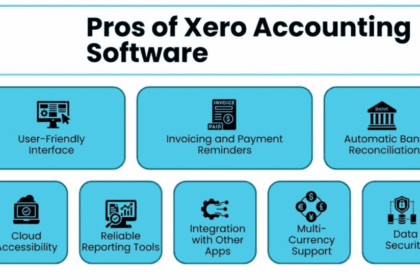

Use secure cloud platforms. Rely on encrypted accounting software such as QuickBooks Online, NetSuite, or Xero for safe data handling.

-

Establish clear data access policies. Limit permissions to authorized personnel and track user activities through audit trails.

-

Sign NDAs and data protection agreements. This formalizes confidentiality obligations between parties.

A reliable outsourcing firm ensures client data is stored, transferred, and accessed securely under strict compliance frameworks.

2. Compliance With Financial Regulations

Virtual AR operations involve handling payments, banking transactions, and customer information—areas tightly regulated under U.S. financial laws. Non-compliance can result in fines or audits.

How to Stay Compliant:

-

Understand regional compliance laws. Follow U.S. GAAP, SOX, and data privacy acts when outsourcing AR functions.

-

Ensure vendor compliance. Verify your virtual AR provider complies with both local and international accounting standards.

-

Maintain proper documentation. Every transaction, invoice, and payment record should be stored digitally for audit readiness.

-

Schedule periodic compliance audits. Regular reviews can identify potential lapses before they turn into costly issues.

3. Process Transparency and Performance Monitoring

When outsourcing virtually, visibility is key. Many businesses fear losing control over customer interactions or payment timelines once AR tasks move offshore or online.

How to Reduce the Risk:

-

Set clear KPIs. Define measurable goals like DSO reduction, collection rate, and billing accuracy.

-

Use centralized dashboards. Cloud tools can give real-time visibility into invoice statuses and cash flow.

-

Schedule regular performance reviews. Weekly or bi-weekly check-ins keep everyone accountable.

-

Maintain open communication. Use collaboration platforms like Slack or Microsoft Teams to stay connected with your virtual AR team.

Transparent systems build trust and allow management to make informed decisions without losing control over outsourced operations.

4. Fraud Prevention and Ethical Safeguards

Virtual AR models rely heavily on remote access, creating potential risks for payment diversion, fraud, or manipulation if left unchecked.

How to Protect Your Business:

-

Implement multi-layer authentication. Enforce role-based access controls and verification for financial transactions.

-

Separate duties. Divide responsibilities among team members for billing, approval, and payment processing.

-

Use AI-driven fraud detection tools. Many accounting systems now flag irregularities automatically for faster intervention.

-

Partner with experienced firms. Choose providers that enforce strict internal audits and employee background checks.

By embedding fraud controls within your virtual AR workflow, you create a secure environment for both you and your customers.

5. Business Continuity and Operational Risk

Outsourcing doesn’t just mean transferring tasks—it involves transferring operational dependencies. Virtual disruptions like system downtime or data loss can directly affect your revenue cycle.

How to Build Resilience:

-

Choose providers with a disaster recovery plan. Confirm their backup frequency and data recovery processes.

-

Document all processes. This ensures business continuity even if there’s a temporary team change.

-

Invest in cloud redundancy. Multi-server hosting protects against unexpected outages.

-

Monitor service-level agreements (SLAs). Ensure uptime and turnaround time are clearly defined in contracts.

The right virtual AR outsourcing partner should be proactive about continuity planning and operational stability, so your cash flow never stops.

Compliance and Technology Go Hand in Hand

Modern AR outsourcing isn’t just about human expertise—it’s powered by automation, AI, and cloud-based accounting systems. These technologies don’t just make virtual AR outsourcing efficient; they also strengthen compliance.

Automated invoice generation, digital audit trails, and real-time payment tracking make it easier to identify inconsistencies and maintain accurate financial records.

When paired with human oversight and a compliance-first culture, technology turns virtual AR outsourcing into a risk-managed, scalable solution for growing businesses.

The Bottom Line: Secure, Compliant, and Future-Ready AR Operations

Risk management and compliance are no longer optional—they’re essential for trust and sustainability. Businesses that combine smart outsourcing strategies with solid governance gain a competitive advantage.

When you partner with a reliable provider for virtual accounts receivable outsourcing, you gain more than cost savings—you gain transparency, control, and compliance assurance.

By integrating data security, regulatory compliance, and continuous monitoring, companies can confidently scale their AR operations without sacrificing trust or efficiency.